How we increased conversion rate by 132% for CORGI HomePlan.

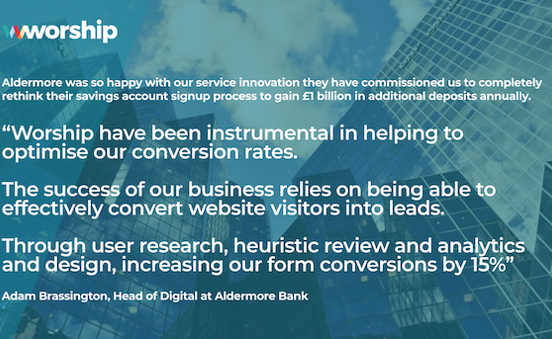

Aldermore Bank

CRO, Data analytics, UX and UI

Aldermore is an award-winning, digital-first bank. Their digital team needed more insight into customer decision-making and behavioural drivers in order to increase the number of people completing their callback request forms. Previous changes they’d made to the website hadn’t impacted behaviour.

Our objective was to increase callback form conversion rate by 10% over 3 months.

Our approach

We developed a programme of research and analysis designed to reveal deep customer insight, which then informed a programme of changes on the website callback forms to increase effectiveness.

Our process recognises that, in financial services, the customers’ purchasing journey may begin on the website, but the buying decision is often completed offline, sometimes weeks or months after the initial website enquiry.

These types of business are often selling complex products/services which require a deeper understanding of the customer than typical web analytics data analysis can provide. This meant we needed to innovate and create our own unique research and analysis framework to help these types of business improve their website’s conversion rate and sell more.

Understanding customers

Our target audiences were the following segments (all looking for mortgages):

We wanted to answer questions such as:

To answer these questions, we used:

We considered all the areas of a business that interacted with customers and made a list of potential sources of insight. We involved all our team members from project managers, to analysts to designers so we could examine all our options. We knew that web analytics data and user research would tell us about website behaviour but we wanted to go deeper by extracting insight from the whole customer journey which could then be used to inform changes on the website.

Our programme of research and analysis revealed that many of the people in these audiences are high anxiety users because they are new to the process, have debt or are self-employed which complicates their case.

The changes we made

We helped users to complete the forms by:

*The revenue uplift is the client’s conservative calculation based on the data available.